is irm stock dividend safe

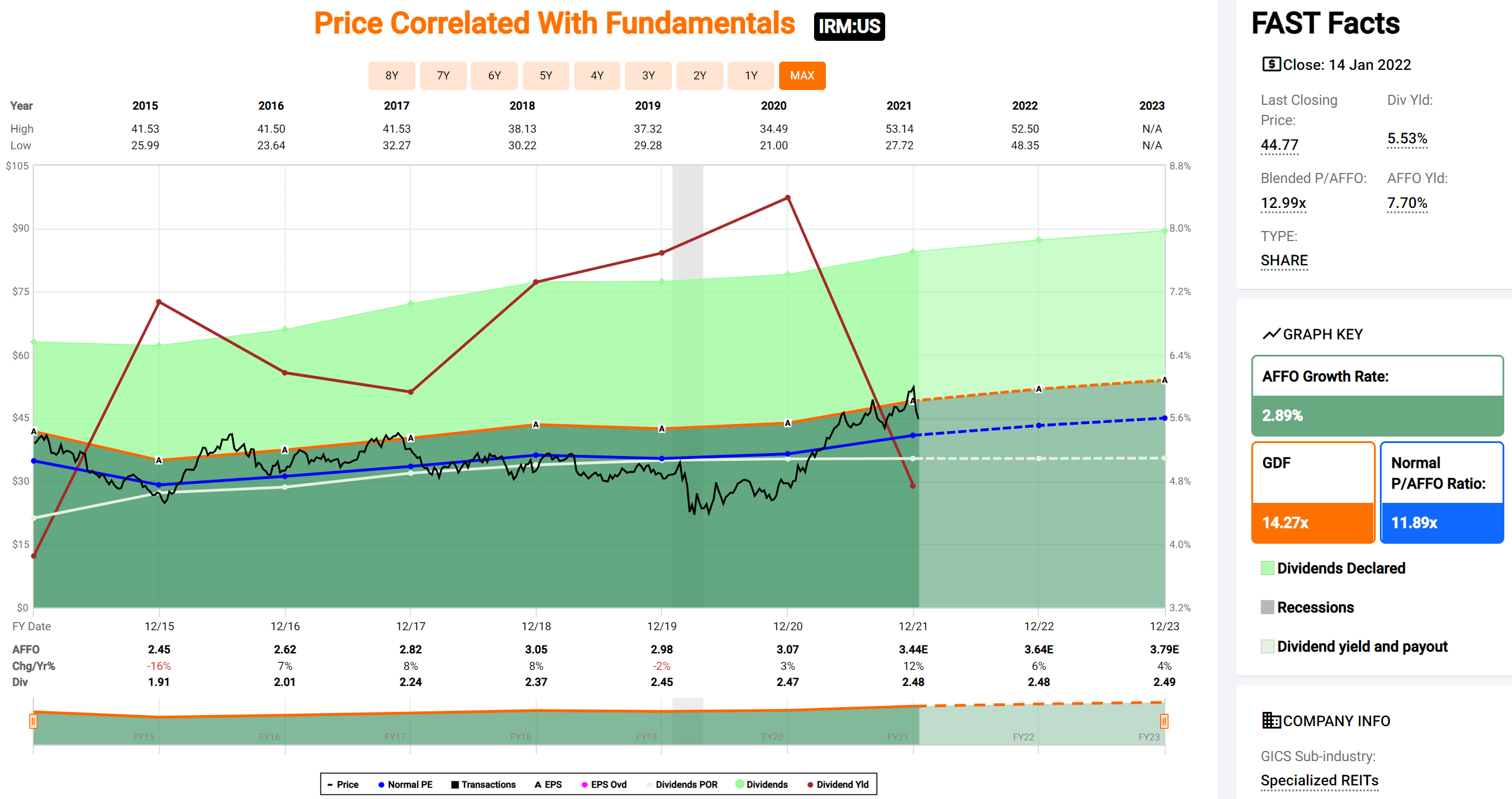

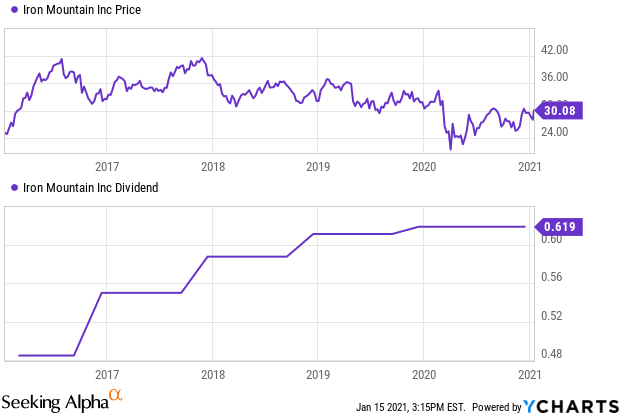

Iron Mountains 26-year growth rate is 165 which is unheard of. It paid a flat dividend rate of 0618 for the past nine quarters a change from its past decade of steady annual yield rate increases.

Iron Mountain A Trusted Name For Storage Digitization Data And Dividends

15936 based on the trailing year of earnings.

. Publicly traded on the NYSE under IRM Iron Mountain is an SP 500 company and a member of the Fortune 1000 currently ranked. That can make it hard to analyze the company but there are some financial truths that. Does Iron Mountain pay a dividend.

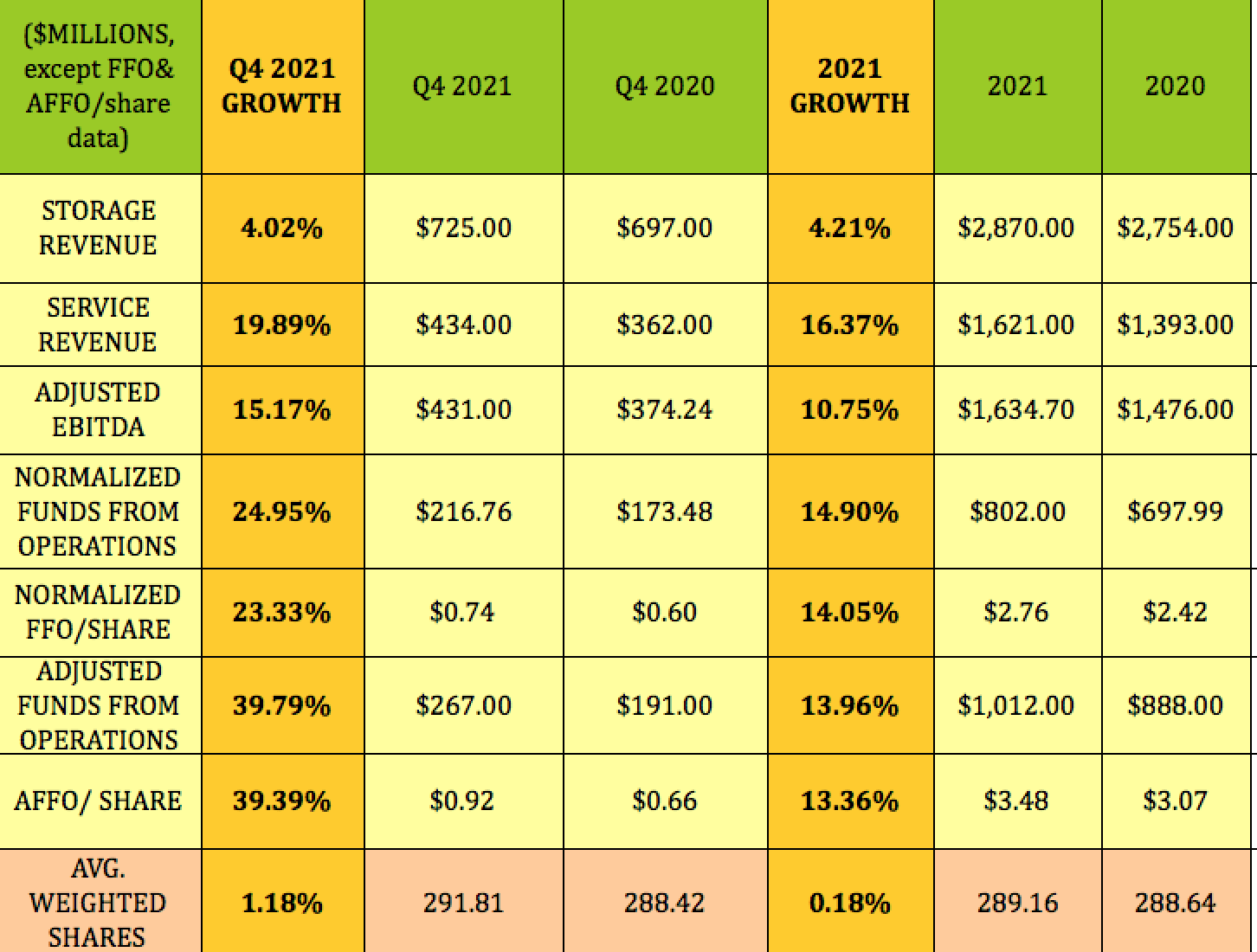

How Safe Are Iron Mountain and Its Dividend. Rosenbaum expects the company to start raising its dividend 6-7 annually starting next year citing the yield as pretty safe On Thursday Iron Mountain issued strong guidance for this year. For 2020 management projects the adjusted fund flows from operations to come in between 9300 and 9600 million.

Not necessarily Iron Mountain has raised its regular dividend in nine out of the last 10 years and it has increased it by 30 over the last five years to 062 quarterly. In a nutshell Iron Mountain not only pays a high dividend but the dividend is pretty safe. This high-dividend stock has seen the dividend increase 776.

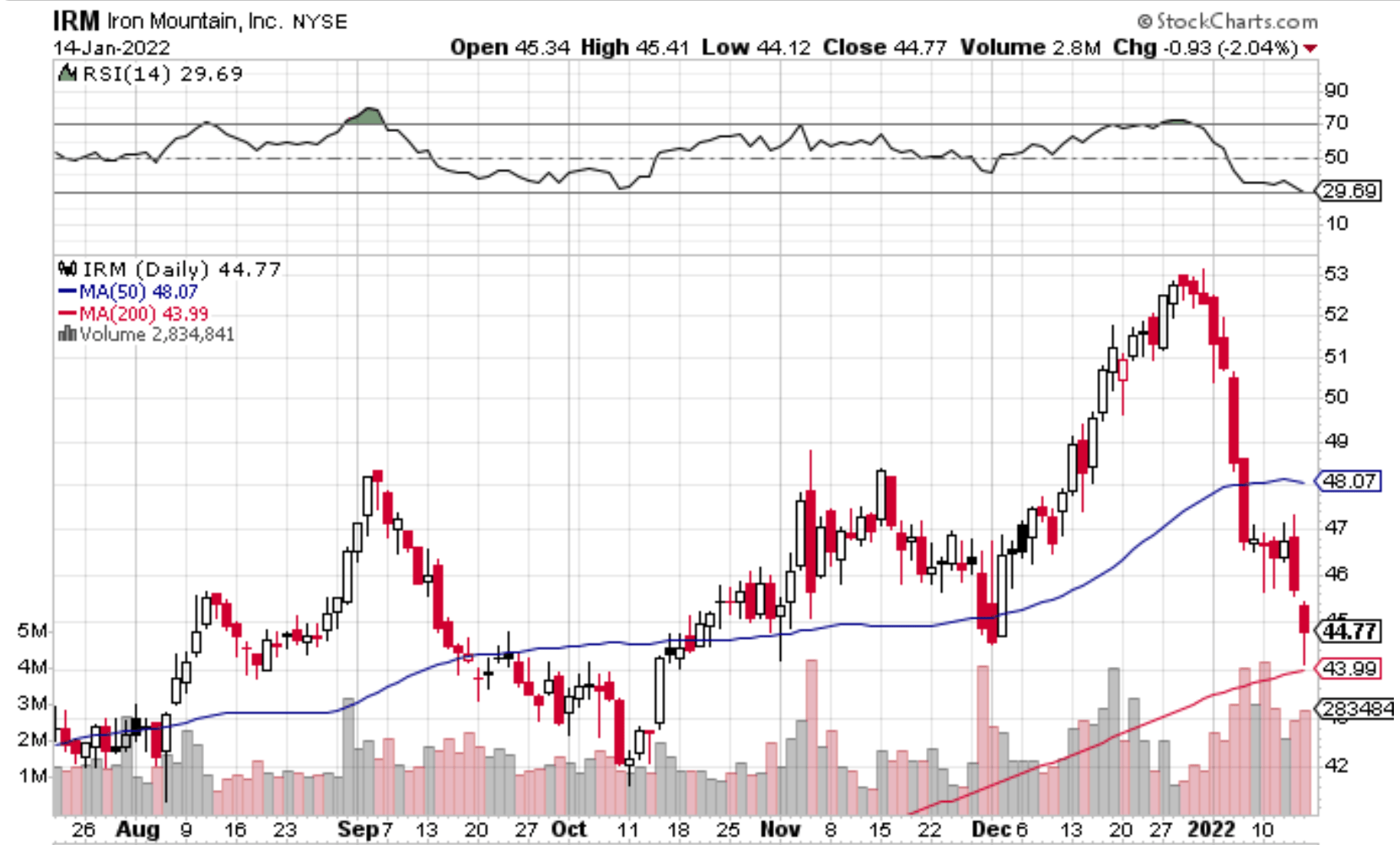

If you have a stock whose dividend youd like me to analyze leave the ticker in the comments section. Market advice from the experts. All of which leaves IRM stocks dividend on solid ground.

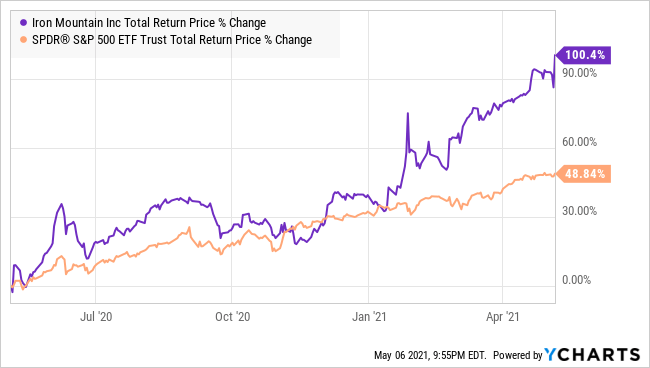

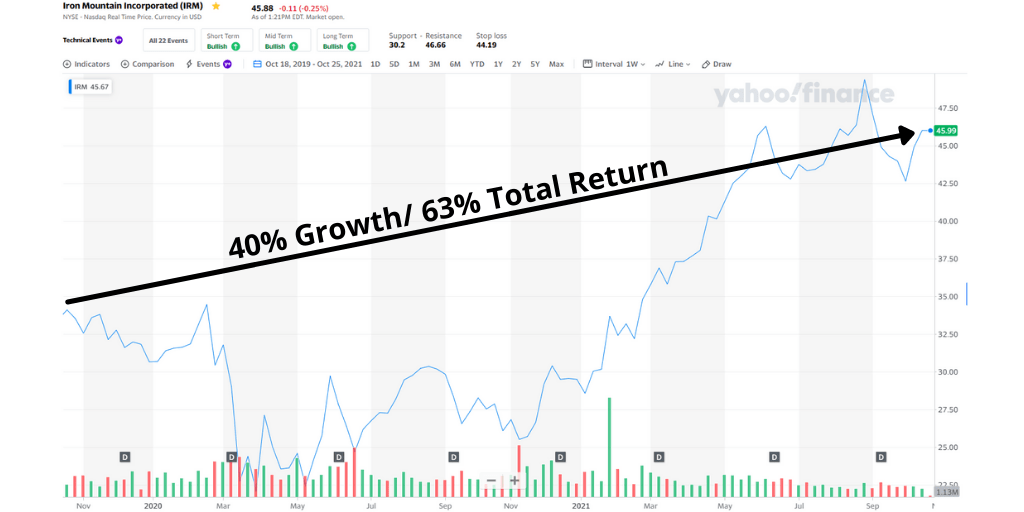

Iron Mountain had been an attractive dividend stock but as IRM share price doubled from the pandemic crash the yield has become less appetizing. Ad The Amazing Stock Dividends. Long-term shareholders were rewarded with special dividends of 262 in 2014 and 406 in 2012.

As a result Iron Mountains Zacks rating improvement implies optimism about the companys earnings prospects which might lead to increased purchasing pressure and a. We expect the company to start raising its dividend 6-7 annually starting next year and we view the dividend as relatively safe. Ex-dividend Dates and Stock Data Free Trial.

The means debt and stock sales are key issues for investors to monitor. When reviewing Iron Mountains dividend profile keep in mind that the company didnt become a. Review IRM XNYS dividend yield and history to decide if IRM is the best investment for you.

This suggests that the dividend could be at risk. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. The historic dividend cover is of course based on historic dividends and earnings.

Iron Mountain NYSE. Iron Mountain Incorporated IRM dividend safety metrics payout ratio calculation and chart. Iron Mountains Dividend Safety Score of 65 indicating that the REITs dividend is safe and dependable.

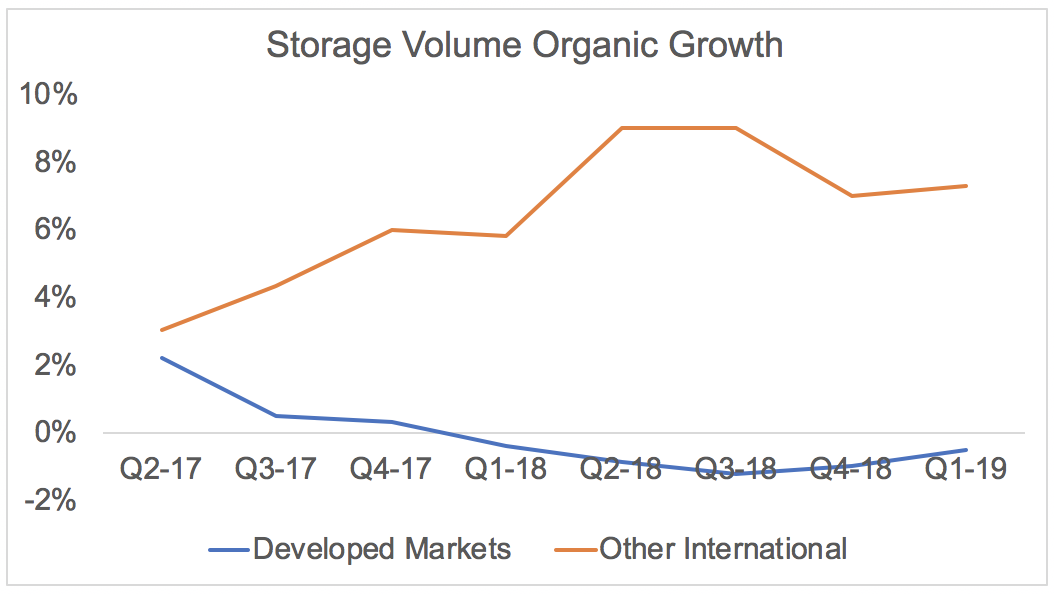

Iron Mountains dividend should be secure for the foreseeable future. But Iron Mountain has a consistently high payout ratio of more than 100 using. Iron Mountain Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets there is a limit to how much expansion can ultimately be achieved from this profitable core business especially as more companies move to paperless ie.

Iron Mountain IRM 081. Dividends of 9 to its shareholders are based on a metric that indicates their reliability. This means that Iron Mountain will likely resume dividend growth shortly after this year.

7866 based on this years estimates. Iron Mountain distributes 93 percent of its earnings based on its earnings. 6238 based on cash flow.

Grow your income with Cabots top dividend stock picks. 7329 based on next years estimates. Our criterion for determining the dividends reliability is 096 out of 10.

Based on the current distribution Iron Mountain stock will pay out around 7500 million to unitholders over the same period. Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. In fact this score is one of the better ones across the REIT sector.

The nine-year track record gives me more confidence as management has shown its commitment to the dividend. Get your free report. 09 Is Iron Mountain a good buy.

The current payout for IRM stock is 0485 or 578 per share based on a price of 3357. The dividend payout ratio for IRM is. Best Dividend Capture Stocks Quickest stock price recoveries post dividend payment.

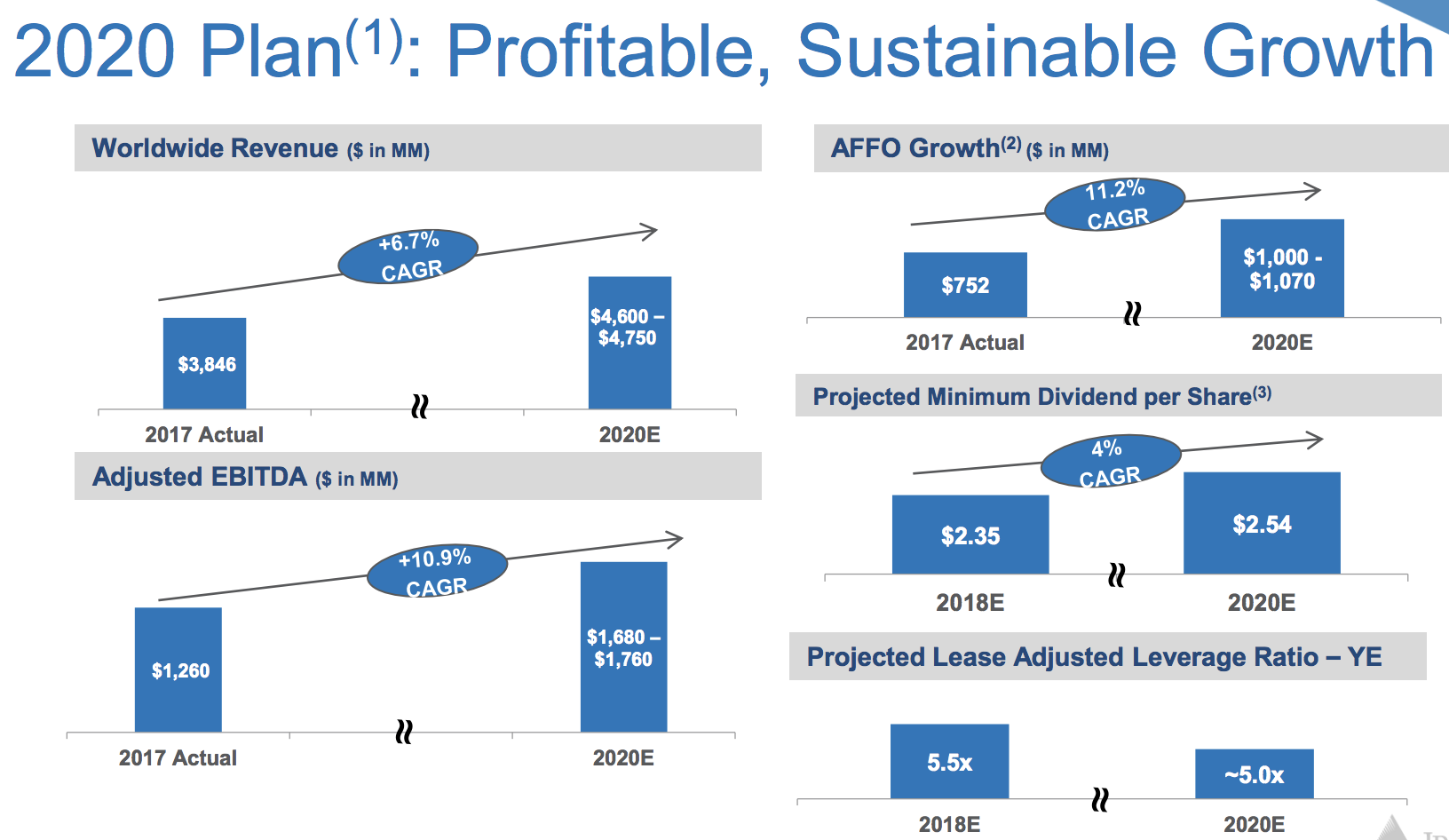

IRM is a unique real estate investment trust REIT that basically has no direct peers. Both of these figures are below the 10x safety threshold for Iron Mountain Inc that we have set. Iron Mountain expects a minimum dividend of 254 for 2020.

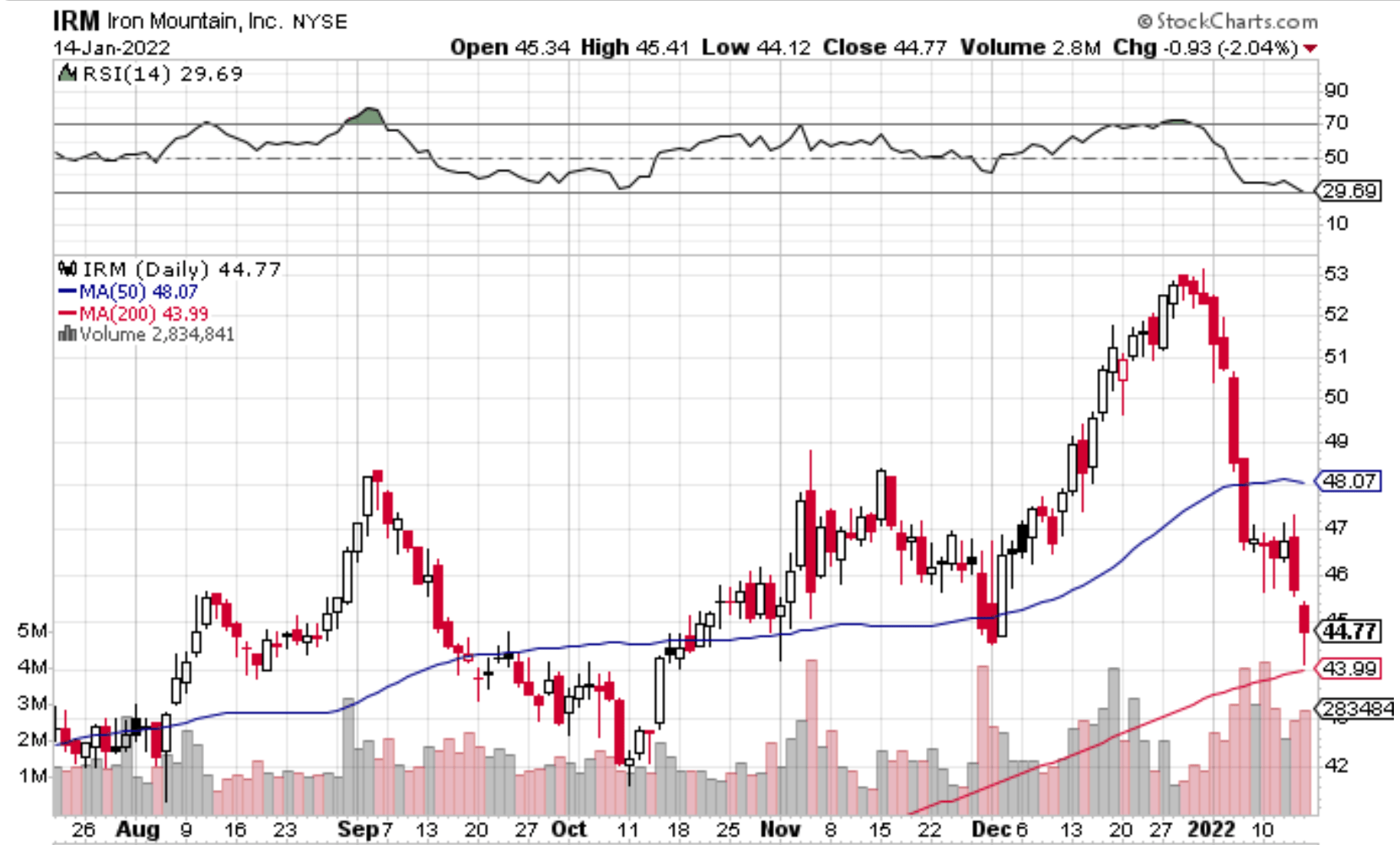

To conclude in my opinion Iron Mountain has fairly strong fundamentals with growth in sales AFFO and a safe and impressive dividend. Iron Mountain Incss historic dividend cover is 043. This is all good news for dividend safety right.

Is Iron Mountain a good dividend stock. The score is 96 out of 100. Iron Mountain Incs NYQIRM heavily geared balance sheet.

Ad Top dividend stock picks and tips from a trusted source since 1970. Is Iron Mountains Dividend Safe. Income investors can scoop up Iron Mountains 5 dividend yield at a price-to-AFFO per share ratio of just 13.

Iron Mountain Stock Why This Cash Cow Is Now A Buy Nyse Irm Seeking Alpha

Iron Mountain Stock Record Earnings 5 Yield 10 Growth In 2022 Nyse Irm Seeking Alpha

8 Highest Dividend Stocks In S P500 Stock Market Tips Ideas Of Stock Market Tips Stockmarketti Finance Investing Money Management Advice Budgeting Money

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain A Strong Performing Reit Nyse Irm Seeking Alpha

Why Iron Mountain Is A Dividend Investor S Dream The Motley Fool

Iron Mountain S 8 2 Yield High Risk High Reward Nyse Irm Seeking Alpha

Iron Mountain Stock At Record Levels Still Has 6 5 Dividend

Iron Mountain Dividend Safety Will This 9 25 Yield Fall Off A Cliff

Iron Mountain Stock Why This Cash Cow Is Now A Buy Nyse Irm Seeking Alpha

Irm Iron Mountain Inc New Dividend History Dividend Channel

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

1 Thing Everyone Gets Wrong About Iron Mountain The Motley Fool

Iron Mountain Inc 8 4 Yielding Stock Could Run Higher In 2021

Iron Mountain Inc Nyse Irm High Yielder Raises Full Year Guidance

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain Stock 5 5 Yield A Must Own Specialty Reit Seeking Alpha