what is an ad valorem tax levy quizlet

Ad valorem taxes are taxes that are levied as a percentage of the assessed value of a piece of property. Ad valorem is a Latin word that translates to according to the value The ad valorem tax is a type of taxation based on a commoditys assessed value like real estate or.

Complete Fl Real Estate Exam 88 Study Guide Flashcards Quizlet

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

. Examples of values that could be used to determine an. What does a tax certificate do quizlet. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

Ad valorem taxes are. Ad valorem taxes are taxes determined by the assessed value of an item. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

What is the meaning of ad valorem tax. The rate represents the. What are ad valorem taxes based on quizlet.

These ad valorem real estate taxes include. -Used by the government as a primary. An ad valorem tax is based on the value of an item at the time of the transaction or assessment.

One prime example is the Value Added Tax VAT which varies in percentage. The most common ad valorem taxes are property taxes levied on. The name of the tax stems from a Latin phrase and means according to value.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Taxing authorities levy this tax based on the sale price of a. An ad valorem tax is a tax levied on the assessed value of a piece of property usually real estate or a vehicle.

The most common ad valorem tax examples include property taxes on real estate sales tax on. Transfer taxes as part of the closing costs in a real estate transaction. The most common ad valorem taxes are property taxes levied on real estate.

The most common ad valorem taxes are property taxes levied on real estate. -Assessed on real property on a regular basis usually annually.

Property Tax Flashcards Quizlet

Structure Of Sales Use Tax Flashcards Quizlet

Transactions And Events I Flashcards Quizlet

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

Study Guide Exam 3 Mirco 7 11 12 Flashcards Quizlet

Editoridaholibrarian Page 2 The Idaho Librarian

R2 M3 Tax Computation And Credits Flashcards Quizlet

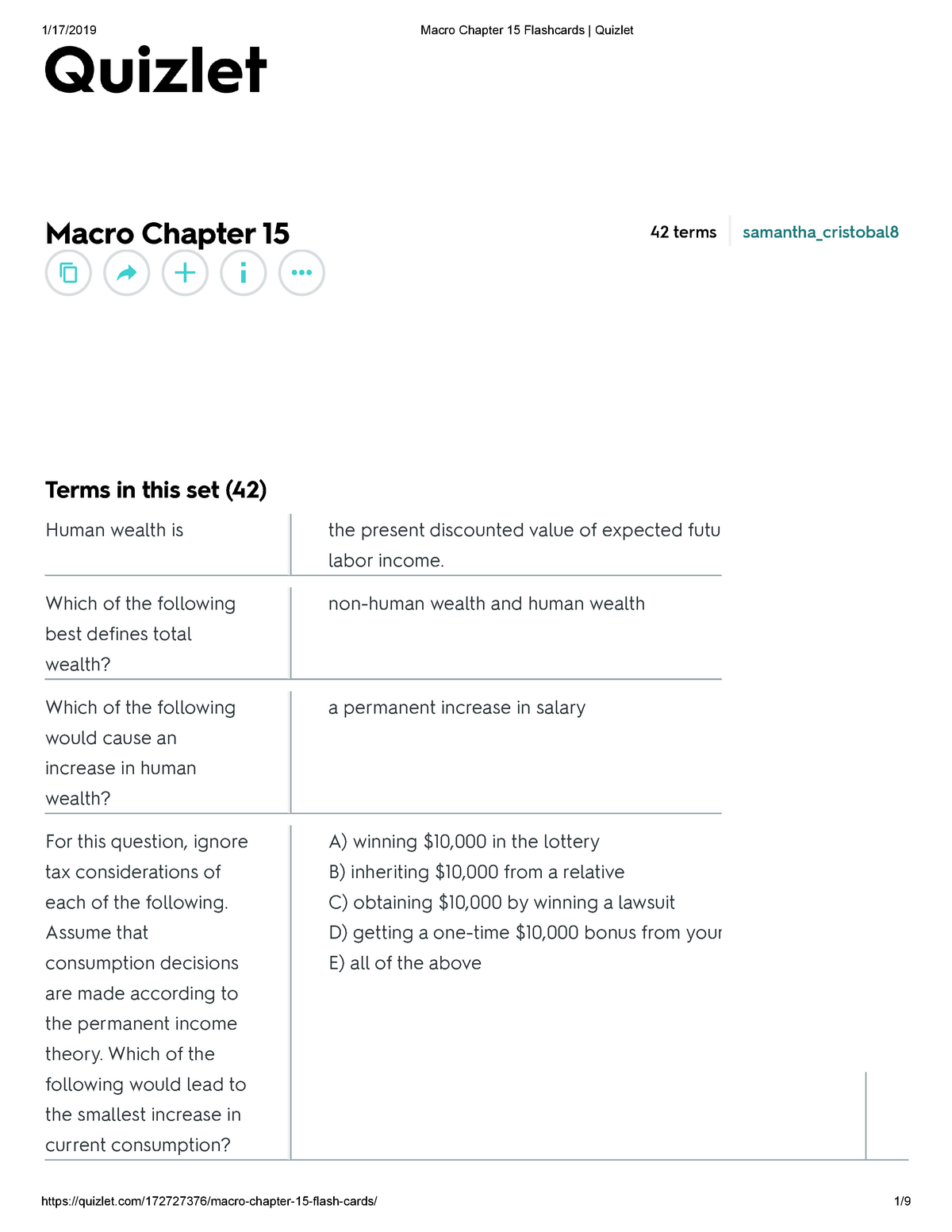

Macro Chapter 15 Flashcards Quizlet 1 17 2019 Macro Chapter 15 Flashcards Quizlet Macro Chapter Studocu

Ch 4 Unit 9 Quiz Flashcards Quizlet

Public Policy Test 3 Flashcards Quizlet

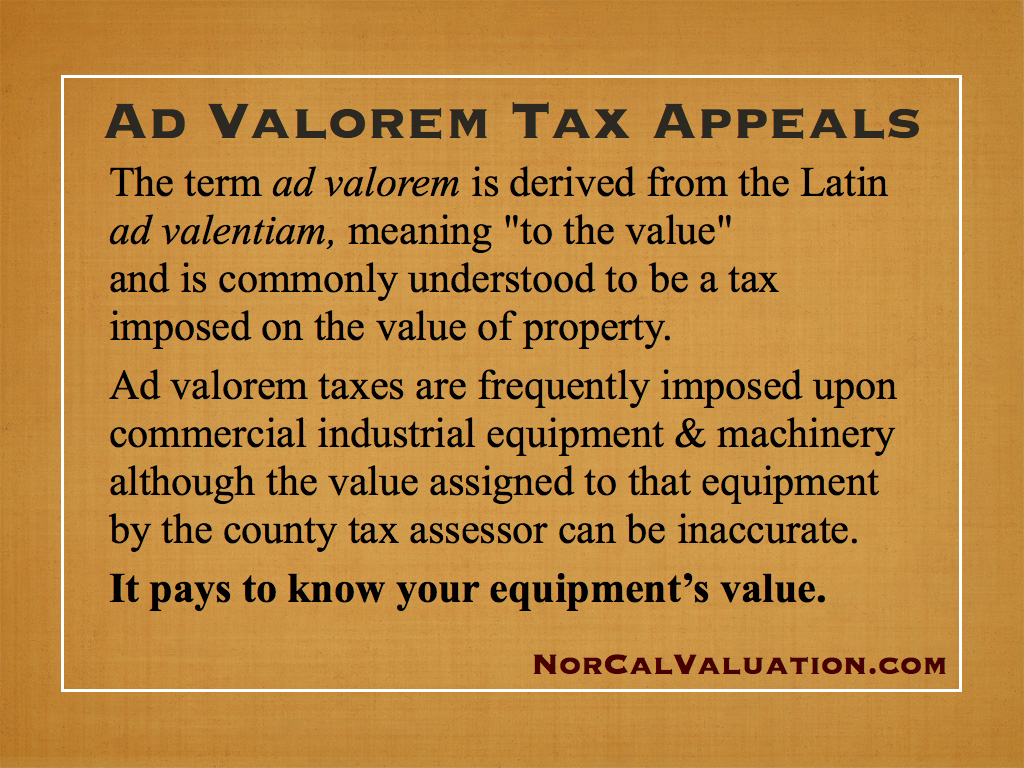

Appraisals For Ad Valorem Tax Appeals Norcal Valuation

What Is An Ad Valorem Tax 2019 Robinhood

Taxes Homework Flashcards Quizlet

South Dakota Caa Exam Diagram Quizlet

Econ Exam 2 Flashcards Quizlet

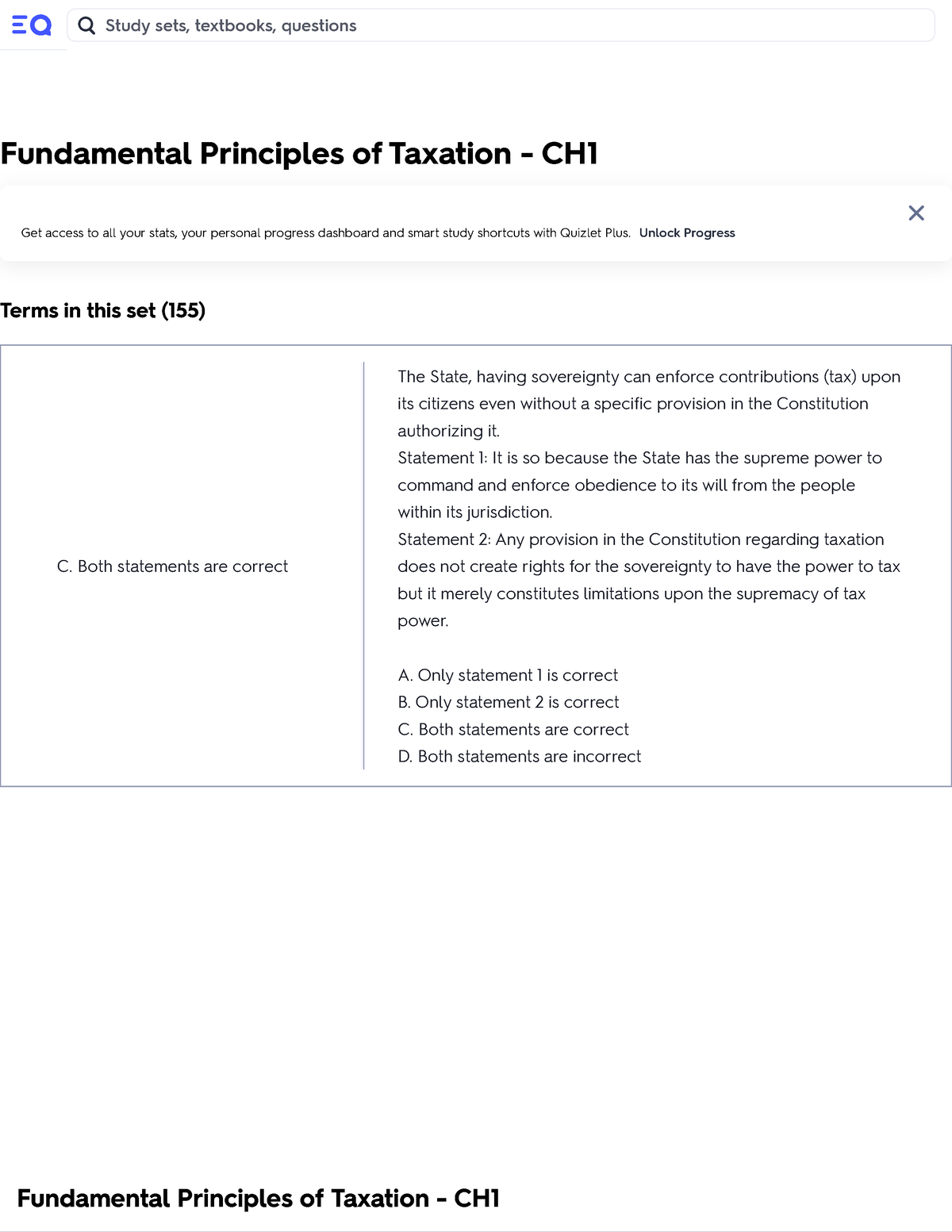

Fundamental Principles Of Taxation Ch1 Flashcards Quizlet Upgrade Free 7 Da 1 Fundamental Studocu

Sustainability Free Full Text Evaluating Conscious Consumption A Discussion Of A Survey Development Process Html